Unlocking the Value of Digital Assistants

In december 2020, KBC (Banking and Insurance) launched Kate to its customers. From the start, I was responsible for designing the architecture of the system and making sure the implementation was successful, evolutionary, secure and cost-effective. In Belgium, after the first release, we focussed on making Kate smarter, while at the same time adding a lot of new use-cases. Kate will now pro-actively help you with your pincode, assist you with payments, support you in finding a cheaper electricity contract and a lot more.

But Belgium was not our only focus. KBC Group has business units in Czech Republic, Slovakia, Hungary, Bulgaria and Ireland as well. We designed Kate to have two dimensions: a global, reusable part and a local, customizable part. This allows us to build local use-cases that benefit from core group components. Working with diverse teams, regulations and business strategies was not without its challenges but led to an interesting and dynamic operating model.

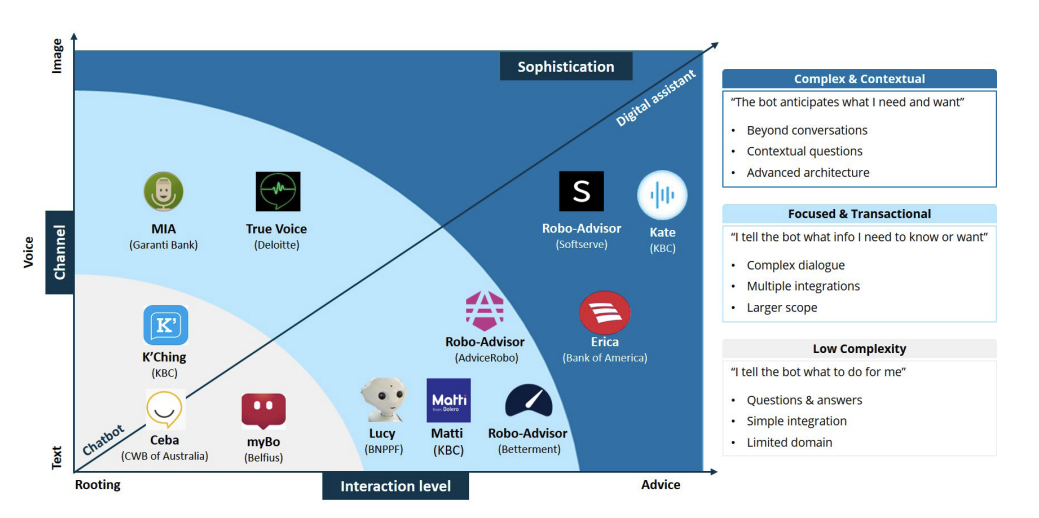

Recently Deloitte published a paper Unlocking the Value of Digital Assistants in which they stated that forward-thinking financial organizations are creating their own digital assistants. These can become the gold standard of digital engagement. They compared a number of large financial organisations (like Bank Of America, BNPPF, Belfius, …) and Kate beat the entire competition! I’d love to share their quote: ‘Kate is an important step for expanding the KBC online platform into a true digital platform, creating an ecosystem of financial and non-financial services’. Kate is an advanced digital assistant that is digitally proactive and offers a complete ecosystem of services that meets the customers’ needs.

Creating Kate was an exciting opportunity and I want to emphasize the strength of our team in doing so! Thanks! All of you. We’ve built something remarkable here!

For 2022, I will be working on a new greenfield product at KBC. Let’s dive into decentralization and Web 3.0.